Is It Better to Overpay Mortgage or Reduce Term

An offset mortgage links your savings to your mortgage and offsets their value against the loan balance. Minimum amount is 10000.

Today Multiple Refinance Rates Dropped Both The Popular Refinance Term 15 Year Fixed And 30 Year Fixed Saw A Refinance Mortgage Financial Decisions Refined

Although shares in Scottish Mortgage Investment Trust LSE.

. For all certificates funded by ACH funds cannot be withdrawn within the first 60 days of the account opening. Overpayments reduce your mortgage balance and will save you interest. This is called an early repayment charge.

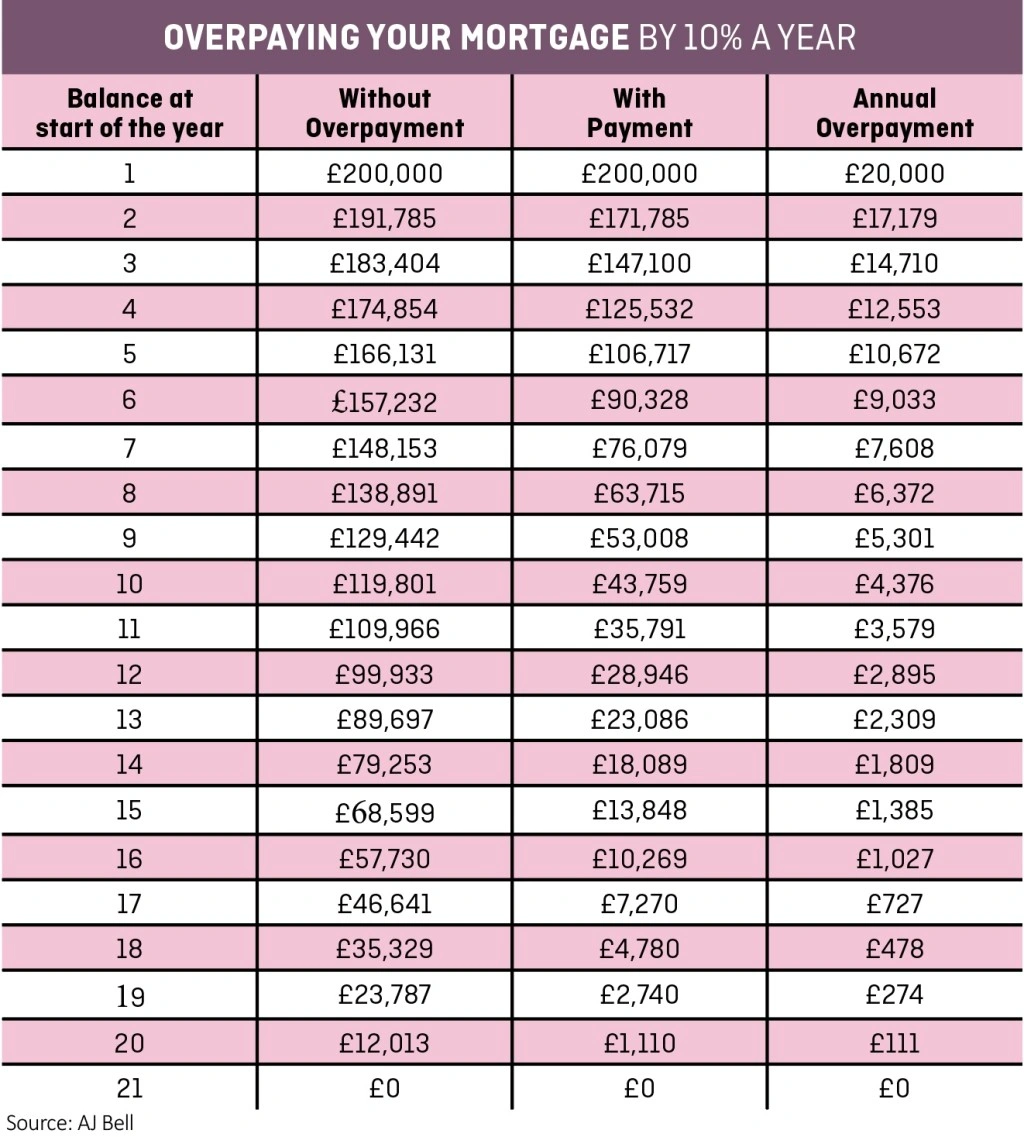

Should I overpay my mortgage each month or ask my lender to officially reduce the term. Overpayments will not always lower your mortgage term. Decreasing the term sounds sensible and does almost exactly the same job that overpaying does both mean you pay more each month you pay less interest and your mortgage is paid off.

With an offset mortgage youre able to use your savings to reduce your mortgage payments by offsetting it against your mortgage thereby reducing the balance you pay interest on. With our mortgage comparison calculators you can find out how much you can borrow what your monthly repayments might look like and what cashback or incentives. Try using our Mortgage best buys to see how changing the length of your mortgage term will affect your payments.

Find a better mortgage deal. If you opt for a longer term your repayments will be lower but it will take you longer to pay off the debt and youll pay more interest overall. Whether youre looking to buy your first home remortgage to save money or move home our mortgage comparisons make it easy to find the best mortgage rates.

How to overpay my mortgage. More things to consider. You gradually repay the loan over the term of your mortgage.

The answer to this almost always is that you should overpay if you have the choice. Applications for additional borrowing are subject to LTV and must meet our current lending requirements. Make all your repayments and by the end of the mortgage term youll have paid it all off.

Once purchased the rate is locked in for the term of your certificate. So if it reduced by 1 your mortgage interest rate will also reduce by 1. You may be charged for overpaying more than your lender allows.

If you decide mortgage overpayments are right for you simply tell your lender you want to make overpayments to reduce your mortgage term. With some lenders youll be able to change your mortgage payment online and arrange for the higher amount to be taken by direct debit each month. If you have a residential mortgage with us in some circumstances you could borrow up to 90 of the value of your home.

Tracker mortgage your interest rate tracks the Bank of England base rate plus a set percentage. SMT have performed strongly over the long term recently things have not been going so well. Certificate dividends are compounded daily and credited monthly.

Check with your lender before you make an overpayment. Over the past year the Scottish Mortgage. However if the mortgage allows you to overpay better to keep the mortgage long to give yourself flexibility then make overpayments.

Shortening the term is a bit like overpaying its far cheaper if youve got the cash. You dont lose your savings in the process as you would if you were to overpay a mortgage or put down a larger deposit but instead agree to put your funds aside and forgo any interest you might have. Minimum term 3 years - maximum term 35 years maximum age 70.

With a repayment mortgage you pay interest on the amount you borrowed and this is included in your monthly instalments. Most people opt for a 25-year term for their first mortgage but you can choose a longer or shorter period.

Should I Pay Off My Mortgage Or Save Raisin Uk

Should I Pay Off My Mortgage Or Save Raisin Uk

Should I Overpay My Mortgage Or Invest The Cash Shares Magazine

Should You Overpay On Your Mortgage Or Invest Your Money Nextadvisor With Time

0 Response to "Is It Better to Overpay Mortgage or Reduce Term"

Post a Comment